Gov. Scott enters fray in Florida pension fund public records dispute

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

||||||||||||||||||

| Description | ||

|

Watchdog City reporter continues to press for public records access By Gina Edwards Watchdog City Press reporter Naples, Fla. April 19, 2013 -- Florida Gov. Rick Scott, at a press stop in Naples on Friday, said he would speak to Florida Pension Chief Ash Williams about this Watchdog City Press reporter’s public records request that’s been held up now for almost six months. “I’ll talk to Ash about it,” Scott said Friday morning. Scott, who campaigned on transparency of the pension fund prior to his 2010 election, said he generally supports transparency and believes that taxpayers and pension holders should know how pension money is used. Gov. Scott serves as a trustee of Florida’s traditional pension fund along with Chief Financial Officer Jeff Atwater and Attorney General Pam Bondi. However Williams, the executive director and chief investment officer, is given wide latitude when it comes to running the pension fund.

The fees and disclosure of these deals are the focus of federal investigations in other states where the use of middlemen has come under fire as part of pay-to-play public corruption scandals in which public officials have been accused of taking gifts and bribes from middlemen to steer pension business to certain funds. Florida began requiring firms to file disclosure forms on fees paid to middlemen in 2009 in response to scandals in California and New York. And these disclosure forms are part of what this Watchdog City Press reporter requested in October. The Securities and Exchange Commission is more broadly looking at whether private equity and hedge funds are ripping off pension funds and other investors on fees, conflicts of interest and bogus accounting.

As part of our on-going “Secret Deals, Public Money” investigation into private equity and hedge fund investments held by public pension funds, this Watchdog City Press reporter also requested basic information that’s designated as public record about the Florida pension fund’s alternative investments in an Oct. 23, 2012 public records request. (See in-depth story) Florida has invested more than $18.7 billion in these types of risky and secretive investments and had invested more than $17.9 billion in active and open private deals as of June 30, 2012. Florida pension managers have invested more than $2 billion in these types of high risk investments in the past year ahead of pension reform bills in the Legislature. House Bill 7011 would require future public employees to join a 401(k) style plan where these types of private equity and hedge fund investments are banned as too risky for individuals. Current employees could stay in the existing traditional pension plan. (See related story) An analysis reported by this reporter earlier in April showed that on only six closed out private equity deals — the pension fund’s only officially closed investments of this type — the funds underperformed what pension managers could have made in the broader stock market by $1 billion over the same time frame. (See related story) A 2006 secrecy law passed by the Florida Legislature keeps vast amounts of information about these private equity and hedge fund deals secret including prospectuses, audits, financial statements and fee agreements with the firms. However certain basic information, including what public money went out and what flowed back to pension fund coffers from these deals, is public record. An amendment to that law, Florida Statute 215.4401, in 2011 specifically designated fees paid to those soliciting pension fund business as public record.

The cash distribution data is needed to conduct an independent analysis on the performance of these private partnership investments that aren’t traded on a public stock market and that have values estimated by the private managers. SBA said in March that providing the information would cost more than $1,000. In its April 10 letter, SBA officials said the government agency had offered to provide the information for a reasonable fee. Rather than providing the identities of principals involved in these 195 investments, SBA officials suggested this reporter look up the names on the SEC web site. Many of these firms were only required to register with the SEC for the first time a year ago as part of the Wall Street reform act. The Florida pension fund investments date back to 1989. “It’s very important that you know how your pension plan is doing,” Gov. Scott said Friday, adding that Florida’s pension fund is well-managed. “I believe in transparency. I believe in giving you as taxpayers and giving you as recipients or participants in the pension plan as much information as possible.”

Get the Full Story! for $0.99 |

| Other Images | ||

|

| Paid Story |

| You don't have permission to view. Please pay for this story to gain access. |

| Paid Video |

| You don't have permission to view. Please pay for this story to gain access. |

| Ask a question or post a comment about this story | ||||||

|

||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||

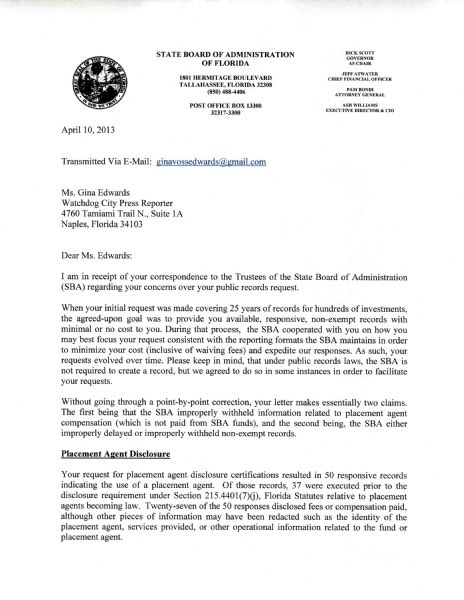

Florida’s State Board of Administration, that oversees the state’s $132 billion pension fund for public employees, asserted in an

Florida’s State Board of Administration, that oversees the state’s $132 billion pension fund for public employees, asserted in an -page-1.jpg)

SBA Response to Gina Edwards April 10, 2013

SBA Response to Gina Edwards April 10, 2013-page-1_th.jpg) Gina Edwards Response to SBA April 18, 2013

Gina Edwards Response to SBA April 18, 2013